It can be tough to keep up with all the acronyms and terminology in the world of finance. One such acronym you may have heard of, but may not fully understand, is ESG. ESG stands for Environmental, Social, and Governance, and it refers to the non-financial factors that can affect a company’s performance. In this blog post, we’ll walk you through how to calculate an ESG score for a bank. We’ll cover each of the three categories of ESG scoring and explain what goes into each calculation. By the end of this post, you’ll have a much better idea of what goes into calculating a bank’s ESG performance.

Calculating an ESG score for any company takes some effort. This is because every company is unique. Consider the various ways that environmental consequences may differ between banking and automobile manufacturing. It’s like comparing apples to monkeys. Equally, compare the social aspects of a large accounting firm to those of a farm. Today, we’re just focusing on what sustainability factors are quantifiable for an average-sized bank.

- How are ESG scores calculated?

- How to begin scoring ESG factors for a bank

- What is the ESG rating for Banks?

- What are Shareholder Rights?

- What is Executive Compensation?

- How do you calculate the bank’s ESG score?

- How do we mitigate the difference between larger and smaller banks?

- ESG FAQ’s

- What do we look at in ESG analysis?

- What does ESG performance scoring involve?

How are ESG scores calculated?

An ESG score sets a baseline for an organization’s sustainable development goals. A good Baseline Score will include things like a sustainable procurement process, indirect greenhouse gas (GHG) net emissions, and fair employment terms. A comprehensive assessment will also include a wide scope of ethical factors and management details. All of these collective factors are then evaluated and weighted to determine an ‘ESG score’ which is used to measure an organization’s overall sustainability performance. This score can be further used by stakeholders to understand the strengths, weaknesses, and opportunities for improvement in terms of ESG initiatives. Get the Checklist! ✅

How to begin scoring ESG factors for a bank

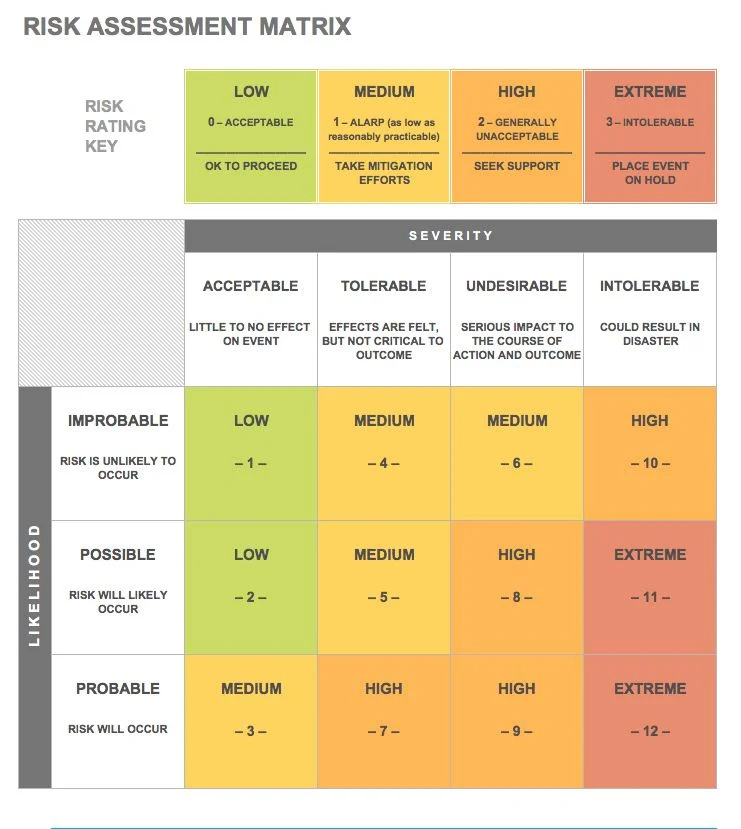

In order to score a Bank for its environmental, social, and governance factors we use the same process as our operational risk exposure where there is a weighted average given from 0 to 3 depending on the importance of each factor.

For example, the weighting given to Board Composition will be different from that given to Waste Management. Board composition is more important overall but Waste Management is also a key factor in one’s business, so the weighting will reflect this.

ESG analysis for financial institutions needs to have 3 components: ESG management systems, governance practices, and risk exposures. To calculate an environmental, social, and governance (ESG) Score we will consider the following 2 variables: Management quality and Operational risk exposure.

What is the ESG rating for Banks?

We use a standardized score and normalize all values. This way it is possible to compare the performance of one financial institution with that of another with a bigger balance sheet simply by looking at their standardized performance score.

1.) Bank Management Quality

Although there are many other factors to consider, we look at three different ESG factors in this category:

- Board Composition

- Shareholder Rights

- Executive Compensation

What is the Board Composition?

Let’s say that we value the board composition of a company with an individual score from 0 to 3. The components we take into account are:

- Board Size

- Mandatory Female Presence

- Diversity of expertise

Board Size: This is composed of the duration that each director has held his or her position (we believe that new directors bring more value) and the number of directors. This is given a weighting of 0 to 3, depending on how long each director has served (0= six months or less, 1= 6-12 months, 2=1-2 years, 3=over two years)

Mandatory Female Presence: We give value to companies with at least one female member on the board.

Diversity of Expertise: This is based on how many different nationalities are represented on the board as well as whether or not they have an economist, a lawyer, or represent another relevant discipline. This is given a weighting from 0 to 4 depending on the number of different nationalities present and if they have a relevant professional.

What are Shareholder Rights?

The rights of shareholders are comprised of whether or not there is adequate transparency, sufficient shareholder voting power, and control over the board. This is given a weighting from 0 to 3 depending on the number of votes per share that can be cast at general meetings, what % of total shares are represented by institutional investors, and how much liquidity is present in the shares.

What is Executive Compensation?

We also value the executive compensation structure of a company with an individual score from 0 to 3 depending on its complexity, alignment with shareholders’ interest, and risk coverage.

2.) Bank Operational Risk Exposure

For this category, we take into account corruption exposure, export concentration exposure, exposure to the financial sector, and exposure to commodity price risk. We give these exposures a weighting from 0 to 3 depending on their level of importance within each bank.

How do you calculate the bank’s ESG score?

We give the bank a rating out of 100 once we have combined all of these elements (which gives us an overall percentage). The index is formed from two separate ratings: one for operational risk exposure and one for management quality.

For Operational Risk exposure, we have assigned a score of 0 to 60 where 0 equals no risk and 60 equals maximum risk. It is composed of 0.5x corruption exposure + 0.3x export concentration exposure + 0.2x exposure to financials +0.1x exposure to commodity risk = 0 to 60.

For Management Quality we have assigned a score of 0 to 40. It is composed of 1x board composition + 1x shareholder rights +1x executive compensation = 0 to 40.

Therefore, in this instance, the bank’s final ESG rating would be 15% for Operational Risk Exposure and 60% for Management Quality giving it an ESG rating of 75 out of 100. Congratulations!

When making this calculation do you include only the listed companies in your analysis?

Answer: In our scoring system, we have a base score of 100. The components that are added together determine what this overall score is. In the perfect world, each component would be worth 20% and then you’d just add them up. But in practice, some components will naturally have a higher weighting than others which means your overall score will be higher or lower depending on how you perceive that component. For example, in this exercise, we are operating on an assumption that shareholder rights are more important than board composition (in general) and so we gave the variables within shareholder rights a different weight than board composition.

You might also want to read

Are all financial institutions included in your analysis?

Answer: No, in this example, we only look at listed companies in our analysis because we want to keep it consistent and fair for all banks regardless of size. For example, HSBC and JPMorgan Chase could not be included in the dataset because they are so big that we would skew the number of institutions included. We want to be able to weigh them according to size.

The importance of including all financial institutions in your analysis is that there are many components that are common across all types of financial institutions, for example, shareholder rights which make up 30% of the overall ESG score. So you have to ensure that what you give less weight to is unique to one type or institution. For example, the impact on the local economy is paid less attention to by a bank because it’s not as important as its environmental impact. However, for an insurer, this component will be given more weight due to the nature of their business model.

And what is the importance of including all financial institutions in general in your analysis?

The biggest difference between banks and other types of financial institutions is that they operate within different regulatory frameworks and so there are different factors to take into account. With insurers, for example, you have to look at the broader impact of an insurer’s business model on society and the economy. For banks, the majority of their exposure is related to financial stability which means that they need to consider things like volatility, credit risk, and interest rate risk. These are taken into account when designing a bank’s stress tests.

How do we mitigate the difference between larger and smaller banks?

Question: If you are assessing all financial institutions then how do you address the fact that larger companies will have more data attributed to them than smaller ones? Do you remove them before calculating your ESG score for Banks?

Answer: You need to ensure that when you are calculating your ESG score, you ensure that all of the components are assigned equal weighting. Only in this way will the scores be fair and transparent for all institutions regardless of size. However, smaller institutions may not generate enough data in certain areas to make an accurate assessment possible.

The best example of how we addressed this is our performance vs. sector analysis. For this, we looked at standardized scores for each of the components to ensure that all sectors were measured against the same criteria. This way, it is possible to compare the performance of one financial institution with that of another with a bigger balance sheet simply by looking at their standardized performance scores.

What do we do with Banking Outliers?

Question: Lastly, what about outliers in your data? Are they removed before calculating your ESG score for Banks?

Answer: Yes, normalizing the raw scores ensures that values are not skewed by outliers. For example, consider a case where one company owns an entire factory which means that its carbon emissions will be much higher than another company with several smaller facilities. This would skew the data and result in an unfair comparison of their environmental impact. However, by normalizing these values you can get a more accurate representation of how they compare to each other.

ESG FAQ’s

What are ESG factors?

ESG factors are environmental, social, and governance factors in a company. These are used to measure the impact of companies on their environment in terms of GHG emissions, energy use, waste production, etc. They also measure how well the business adheres to international standards in social areas such as the treatment of employees or suppliers or the protection of minority shareholders. And finally, they are used to measure governance practices such as how well it adheres to international laws and regulations and the quality of its board and ownership structure.

What are ESG risks?

ESG risks refer to the risks to the business which are related to environmental, social, and governance factors. These can include energy price risk, water price risk, shortage of raw materials, political instability, etc.

ESG analysis is used to measure the risks that companies face due to their impact on society and their environment.

What do we look at in ESG analysis?

ESG analysis is used to measure the risks that companies face due to their impact on society and their environment. This is to mitigate risks and ensure that a company is able to be sustainable in the long run. But also in doing so, we may unearth some opportunity that has been overlooked by others.

What does ESG performance scoring involve?

One methodology that includes 19 ESG factors. For each company that received a company profile, all of the 19 factors were applied. Each score was then converted into a percentile rank across all companies in that sector. The scores are based on the highest-scoring company for each factor.

When these percentiles are averaged together to create an overall ESG performance score, one can see how well companies performed vs. their peers. However, it lacks an overarching data set that takes the accelerated timeline of the climate crises into account. Keep in mind that this article’s data points do not include the criteria for rating your personal ESG score.

S&P’s 19 basic ESG factors:

- Board Composition

- Board Diversity

- Gender Diversity

- Supply Chain Management

- Corruption Exposure

- Export Concentration Exposures

- Financial Sector Exposure

- Commodity Risk Exposure

- Operational Risk Exposure

- Risky Business Involvement

- Anti-Bribery & Corruption Policies Compliance

- Employee Treatment & Working Conditions

- Procurement Practices & Policy Compliance

- Human Rights Concerns Policy Compliance

- Environment Management System Compliance

- Emissions & Energy Use

- Waste Management

- Water Management

- Sustainability Reporting Compliance

What are ESG analysis services?

ESG analysis is used to measure the risks that companies face due to their impact on society and their environment. This is to mitigate risks and ensure that a company is able to be sustainable in the long run. But also in doing so, we may unearth some opportunity that has been overlooked by

How do we incorporate the climate crisis timeline into ESG data?

The climate change crisis has done significant damage to the planet. If we take into account this accelerated timeline, then it is crucial that companies produce ESG data that reflects this urgency. The GHG emissions are speeding up, water reserves are depleting rapidly and waste production has increased greatly over the last decade. As a result, ESG benchmarks should reflect this data to show the accelerated timeline.

What is ESG performance?

ESG performance is measured over a period, usually the last three years. The ESG performance index is derived by weighting an organization’s sector scores in different categories according to their relative importance in that sector. The scoring system creates a final overall score representing the overall quantitative impact of an organization’s social and environmental policies on its long-term financial sustainability. Then this should be measured against the climate crisis accelerated timeline.

In conclusion ESG scoring

In conclusion, ESG is an important metric used to monitor the risks that companies face due to their impact on society and their environment. This allows for the mitigation of risk but also may create opportunity that has been overlooked by others. Every company is different, so there is no one-size-fits-all approach. Because of this, it is recommended to use the high-performing company for each sector as a baseline to measure against. Facing the climate change crisis head-on, we need ESG performance that reflects this accelerated timeline. Therefore it is crucial that the data incorporated into ESG benchmarks reflect this urgency.

Astute business leaders have also read…

Caveats, disclaimers & ESG ratings

At ESG | The Report, we believe that we can help make the world a more sustainable place through the power of education. We have covered many topics in this article and want to be clear that any reference to, or mention of managing good ESG scores, financial institutions, carbon emissions vs. corporate disclosures Industry, or Insights in the context of this article is purely for informational purposes and not to be misconstrued as investment advice or an endorsement. Thank you for reading, and we hope that you found this article useful in your quest to understand ESG and sustainable business practices. Long live planet Earth.

Dean Emerick is a curator on sustainability issues with ESG The Report, an online resource for SMEs and Investment professionals focusing on ESG principles. Their primary goal is to help middle-market companies automate Impact Reporting with ESG Software. Leveraging the power of AI, machine learning, and AWS to transition to a sustainable business model. Serving clients in the United States, Canada, UK, Europe, and the global community. If you want to get started, don’t forget to Get the Checklist! ✅