What is ESG and How Does it Affect Climate Change?

What is ESG and How Does it Affect Climate Change?

You have likely heard it many times by now, but just to be clear – ESG (Environmental, Social, and Governance) is the term used to describe the various non-financial factors that may impact an organization’s long-term performance. They also affect the long-term sustainability of our societies and our planet. Environmental issues such as pollution and wildlife preservation are often included in ESG discussions along with social considerations like unemployment rates and wage disparity. Governments also play a key role in ESG by regulating environmental and labor policies. ESG is often viewed as an extension of the more traditional financial decision-making process known as CSR. But the bottom line is that if we want to stop climate change, we will need better ESG policies from industry.

However, many argue that organizations should integrate their management practices for ESG into their core business strategy rather than treating it as a separate issue altogether. And there are hybrid models emerging in the market. It is believed that it helps companies better identify the areas where they are more likely to have a positive impact faster. Ultimately, it will help them set their ESG goals and force companies to implement sustainable practices.

What is an ESG Report?

Recently, with the pandemic and the invasion of Ukraine, there is pressure to divest from Russian oil and the end of any globalization plans. This is forcing the business sector to be more transparent by publicly disclosing data on their environmental practices for stakeholders and shareholders to see. The idea of increasing transparency is that by sharing information with the public, companies can show how serious they are about investing in sustainable practices. This would also instill consumer confidence and increase their willingness to patronize corporations that embrace environmentally friendly policies. However, just as with CSR-related disclosures, there are critics who say these reports may not effectively represent companies’ ESG activities or don’t paint a full picture of the risks they face from climate change effects, but it is a start. And things are changing faster now than they ever have.

What are the three components of ESG?

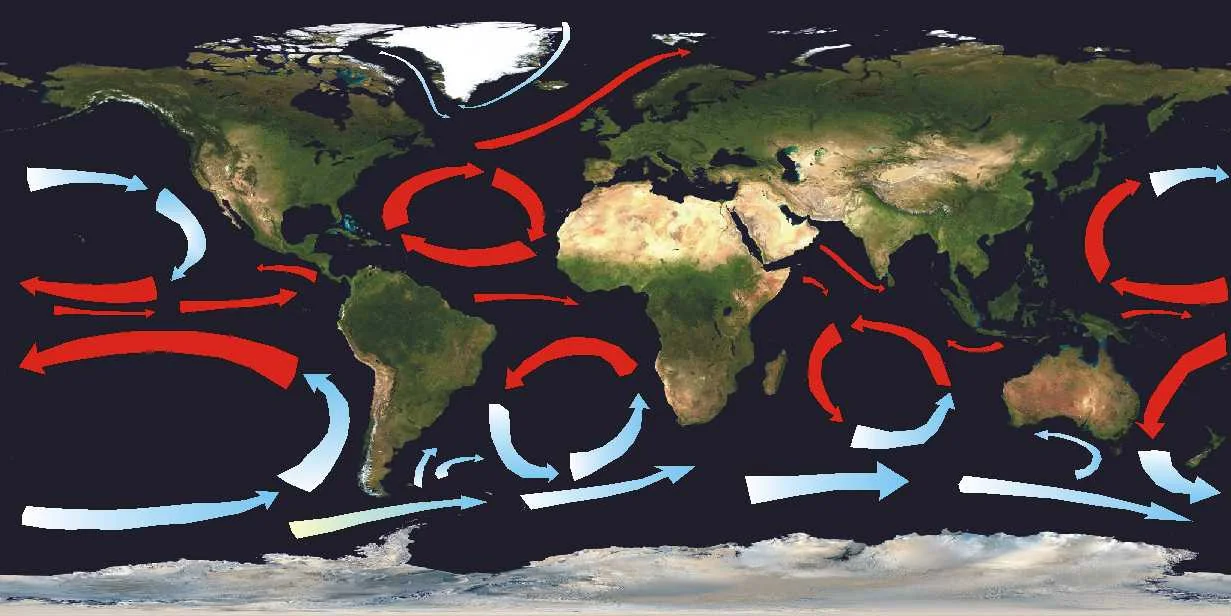

- Environmental issues include changes in biodiversity due to deforestation and illegal hunting, changing weather patterns such as flooding and drought due to natural disasters like hurricanes and typhoons, loss of human life and wildlife, and the degradation of our atmosphere including the Ozone layer.

- Social issues include child labor, unsafe working conditions for employees in factories around the world, underpayment or no payment of employees, human rights violations against peaceful protestors or whistleblowers, and poor conditions for those who work in many industries.

- Governance issues include bribery, corruption within governments – especially when it comes to environmental concerns about corporations, information asymmetry where one group has more knowledge than another regarding something being sold to them, price fixing among competitors which means that prices are kept artificially high, lack of corporate transparency, and governments that do not allow their citizens to have the right to vote.

Is climate a part of ESG?

Yes, climate represents a third of ESG. Climate change is the greatest threat to human health, and this includes malnutrition and starvation, increases in infectious disease, extreme weather events such as floods and droughts, increased frequency of wildfires, loss of livelihoods (and ensuing social unrest), forced migration from affected areas (which can lead to immigration issues as well as increase in crime rates) and loss of human life.

How does climate change affect business?

The risks associated with climate change have a massive effect on businesses. For example, severe weather events such as floods and droughts can damage physical assets such as property and equipment; changes in temperature, rainfall, and natural disasters like hurricanes and typhoons can impact agricultural yields (this can lead to increases in food prices and decreased wages for agricultural workers); increases in the frequency of wildfires can reduce timber supplies which impacts profit margins.

What does this mean for businesses?

It means that any actions that are taken to reduce climate change should also be viewed as opportunities for future growth. The fight against climate change requires a large amount of time, money, and other resources. Businesses can look at this as an opportunity to get ahead by investing in sustainable energy sources, by increasing recycling efforts on their part or even reducing the environmental impact of their material suppliers. ESG considerations should be included in a business’s long-term plans and goals because they offer an opportunity for growth.

What is ESG investing?

ESG investment is a type of investment that tries to earn a positive social and environmental impact as well as a financial return from the investor. The goal of ESG investors is to have their money generate not only profit but also positive change in society and the environment.

Is ESG part of impact investing?

ESG in the context of climate change refers to environmentally sustainable practices undertaken by companies in order to mitigate their negative environmental impact while continuing to make a profit. Examples include using recycled paper for memos, paying employees a living wage so that they can afford healthy food and get enough sleep, or developing green buildings with features like solar panels.

How has ESG investing become popular?

ESG investing became popular because it is appealing to socially responsible people who want to use their money for more than just profit. They also want their investments to have positive change in society and the environment. ESG investing became popular during the mid-2000s when investors started to merge the values of financial return and community values.

In 2008, The United Nations Principles for Responsible Investment (UNPRI) was launched as a global network of investors committed to incorporating ESG factors into investment analysis and decision-making processes. There are more than 22,000 signatories representing $59 trillion in assets.

What is the impact of ESG investing on climate change?

ESG investing can have a positive or negative impact on climate change depending on how environmentally sustainable the investment is. If the investment focuses on companies that contribute to carbon dioxide pollution, then it will potentially contribute negatively towards reducing climate change.

What are climate-related financial disclosures?

Climate-related financial disclosures are statements that are made by an organization trying to convey the potential risks of climate change on its financial health. These statements may include disclosing any physical impacts of climate change, disclosing risk management strategies for dealing with climate-related issues, or mentioning how climate change could have a positive or negative impact on future earnings.

Savvy Investors are also reading…

Why is ESG investing important?

ESG investing is important because it attempts to increase financial returns while also avoiding or mitigating any negative environmental, social, and governance impacts that the investment might have. ESG investing is important because it leaves a positive impact on society and the environment as well as giving a good return on investment.

Is climate change caused by humans?

Yes. Climate change is a natural process that happens over millions or billions of years. The last ice age took place over a million years ago and the next one is expected to happen in 50,000-100,000 years. However, humans have impacted the climate by burning fossil fuels for energy and land clearing which has accelerated the process of global warming. This is evident by the fact that the Earth is about 1°C warmer than it was in pre-industrial times.

In 1750, CO2 levels were around 280 ppm and today they are at 400 ppm. The rate of change has grown exponentially over the last two centuries because humans burn fossil fuels at an unprecedented rate.

What is a billion-dollar storm?

Billion-dollar storms are extreme weather events that cause at least $1 billion in damage. Hurricane Harvey, which hit Houston in 2017 caused around $125 billion in damages and Hurricane Maria, which hit Puerto Rico in 2017 caused about $90 billion in damages. There are more than 90 extreme weather events per year that cause economic damage to the tune of billions of dollars. This is not only financial but also an effect on human lives which must be taken into account when evaluating the cost of these events. And their length and intensity are only increasing due to climate change.

You can’t improve what you don’t measure.

Free Verified Carbon Calculators.

Is there a difference between extreme weather and climate change?

Extreme weather refers to short-term weather conditions that are significantly outside of the normal weather conditions in an area. Climate change is a gradual process that is taking place over many years and it is caused by human activity. Climate change is evident by the increased number of billion-dollar storms, increased temperatures all around the world, melting ice caps and glaciers, etc.

Extreme weather events are becoming more frequent and more severe due to climate change which is caused by humans.

ESG investing has the power to slow climate change, increase the equity of those that have none and make a profit.

What are the benefits of ESG investing?

ESG funds typically have a lower risk compared with traditional financial assets since they tend to be invested in companies that adhere to stricter guidelines on environmental sustainability, workforce diversity, and governance policies. They also

In conclusion ESG factors and the supply chain

In conclusion, ESG is important because it has the power to save the environment, slow climate change, and increase the equity of those who have little or none. Happy people mean a happy planet. ESG investing is a tool that we can use individually to reduce greenhouse gases, provide a living wage for everyone, and push for innovation which will lead to sustainability.

Caveats, disclaimers, and ESG climate change

At ESG | The Report, we believe that we can help make the world a more sustainable place through the power of education. ESG investing or sustainable investing, is a big part of how we can affect climate change and reduce global warming. ESG funds focus on climate-related financial disclosures to address climate-related risks, which is the fiduciary duty of the investment management team in identifying sustainable investments.

We do not endorse any mutual funds that are advertised as responsible investments whether they are in line with the UN sustainable development goals or not. The contents of The Report, which may contain terminology like climate change risks or climate change risk, ESG funds, greenhouse gas emissions, and climate risk are intended for informational purposes only.

Astute business leaders are also reading…

We also do not endorse any ESG investment options or persons from the investment industry, whether they are discussing ESG risks, climate crisis, risk alert, corporate governance, ESG strategies, or green living options because we are only meant for informational purposes. Our ESG mandate on environmental issues and climate action is not to be misconstrued as advice from financial professionals but as practical examples from a small task force to provide info related to ESG issues or asset owners.

Any ESG criteria in relation to the investment process, waste management, energy efficiency, or reporting standards are for education purposes. Any mention of ESG issues, social and governance issues, investors, human rights, investment, investment, investments, or climate is not to be considered as advice.

While the website contains all kinds of newsworthy it is our concern that the global market will increase its demand and interest in the economic value of sustainability. Our information is researched and gathered from many public sources and may include words or phrases like factors, risks, governance, investing, assets, risk, case studies, fund, future, regulation, management, funds, data, markets, and finance not to be misconstrued as investment advice. Thank you for reading, and we hope that you found this article useful in your quest to understand ESG and sustainable business practices.

AUTHOR BIO

Research & Curation

Dean Emerick is a curator on sustainability issues with ESG The Report, an online resource for SMEs and Investment professionals focusing on ESG principles. Their primary goal is to help middle-market companies automate Impact Reporting with ESG Software. Leveraging the power of AI, machine learning, and AWS to transition to a sustainable business model. Serving clients in the United States, Canada, UK, Europe, and the global community. If you want to get started, don’t forget to Get the Checklist! ✅